GUILLAUME YON

If you have recently been online looking up for flights, you may have noticed that prices for airfares are always in flux. But what online shoppers usually do not know is that these dynamic price changes are enabled by large and intricate technological systems powered by cutting-edge science and technology.

These systems were first deployed by airlines in the United States in the 1980s. Up until today, they have been an object of intense scientific and technological research and development. When deploying such systems in airlines at scale, engineers and scientists blend statistics and probabilities, mathematical optimization, computer science, and economics, all this to implement sophisticated business strategies.

Dr. Guillaume Yon

Guillaume Yon is a historian of economics, who researches and teaches how the ideas that shaped our economic thinking emerged. He is particularly interested in the economic knowledge produced by engineers working in industry.

In the talk I delivered at the Käte Hamburger Kolleg ‘Cultures of Research’ on December 13th, I focused on what is often considered as the first of these systems: DINAMO. DINAMO stands for dynamic inventory and maintenance optimizer. It was developed at American Airlines and was fully operational in 1988. Similar systems were implemented at other major airlines in the United States around the same time, and these systems came to be known to specialists as ‘revenue management’ systems.

What was the problem that American Airlines’ engineers had to solve? As the airline industry was being deregulated in the U.S. (a process completed in 1978), American Airlines’ marketing department came up with a new strategy, which had two connected components.

The idea was to offer multiple price points for the same seats in the same class of service on the same flight. At the time, aircrafts had two classes of service, first and coach. Coach was the second class and main cabin, as in trains in Europe these days, and less like today’s economy seats in airplanes. In coach, American Airlines’ flights were regularly departing half-empty, hence the idea, in order to fill up these empty seats and avoid the associated loss in revenue, to stimulate a new demand, coming from people travelling for leisure. Before deregulation, air travel was a luxury product, and American Airlines was not alone in thinking that there was an untapped and potentially huge new market out there: middle-class families going on vacation, college students coming back home, young couples going away for the weekend, senior citizens visiting their children and grandchildren. However, these new leisure travelers were price sensitive, hence the need for a price discount to attract them, and fill the empty seats.

The second component was to prevent American Airlines’ already existing business customers, who travelled in coach too, from buying at the discounted price. Business customers were less price sensitive than the new leisure travelers, as they traveled on company money. They were willing to pay more for the same seat in coach. If business customers could buy the discounted fare, the new strategy would only result in a new source of revenue loss, this time from the business travelers’ side. American Airlines’ marketing department came up with the idea to tie the discounted prices to restrictions. For instance, American Airlines Ultimate Super Saver, a fare launched in 1985, was cheaper than the full fare for the same seats in coach. However, it was available only up to 30-days before departure (the so-called ‘advance purchase requirement’), had a steep cancellation fee, and was available only to those buying a round trip ticket with a Saturday night stay. Business travelers could not abide to those restrictions. They tended to book later and wanted to spend the weekends with their families. Therefore, even though discounted fares were available for a flight, business travelers would carry on buying at a higher price the seats on the same flight.

The outcome of American Airlines’ new pricing strategy was that for a given flight – from A to B, with a given departure date in the future – the seats in coach were offered at different prices with different restrictions (the lower the price, the more stringent the restrictions). These different ‘fare classes’ were available for sale at the same time. This new marketing strategy was a tremendous success for American Airlines, and it played an important role in turning air travel into mass transportation.

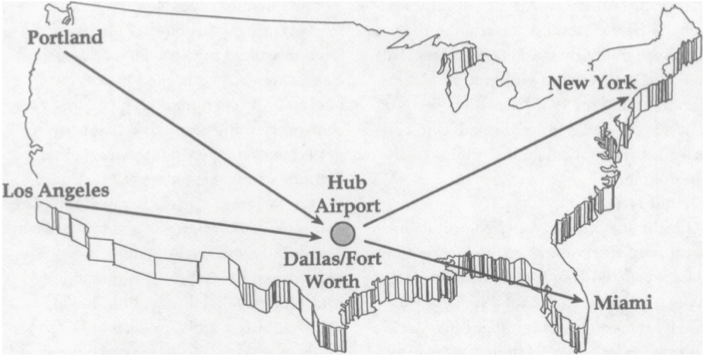

This tremendous success from a revenue perspective turned into a nightmare from a business process perspective. At American Airlines, hundreds of new revenue management analysts were hired, and they were struggling. Each revenue management analyst had a set of flights to manage. They needed to decide, for each flight, how many seats should be made available for sale in each fare class in order to obtain, at the flight departure, the mix of passengers which maximizes revenue. That decision needed to be made at first a year before departure, when the flight opened for booking. In the mid-1980s, there were at least three different fare classes in coach (the full fare, the Ultimate Super Saver, and a Super Saver in between), in addition to the first class, on each flight. Worse, American Airlines re-organized its network after deregulation as a hub-and-spoke, in order to efficiently serve more destinations domestically and internationally. Each path in the network with a connection at the hub also had at least three fare products in coach. For the local traffic, if the analyst allocated too many seats to the lowest fares, it could displace high paying business travelers. But allocating too few seats to the lowest fares could mean departing with empty seats, if high paying demand did not materialize late in the booking process. Simultaneously, for the same flight, the analysts needed to decide what the revenue maximizing mix of local and connecting traffic was. Was it best to have one more seat protected for a high paying business passenger on that flight, or have one more discounted passenger on the same seat but with a connection to a long-haul expensive flight? It depended on the price each of those two passengers paid, the likeliness of each passenger showing up for booking, and how full each of the two flights were. Humans could not possibly make all these decisions efficiently at scale. Therefore, around 1982/1983 American Airlines management tasked its operations research department with automating the process.

Source: Smith, Leimkuhler and Darrow (1992) ‘Yield Management at American Airlines’ Interfaces 22 (1), pp. 8-31.

To automate the process, operations researchers started thinking from the actual available technology: SABRE (for semi-automated business research environment). SABRE was big tech at the time. It was the first global electronic commerce infrastructure, allowing travel agents to sell tickets through a dedicated terminal, connected to American Airlines inventory in real-time, by telephone transactions. SABRE was also an amazing database, as it recorded the numbers of bookings for each fare class on each flight. However, for revenue management analysts, this deluge of data was overwhelming.

Source: IBM; https://www.ibm.com/history/sabre; Last Accessed Jan. 2024.

American Airlines’ engineers aimed at overcoming the limitations of human decision-making through automation. To do so, they needed to redesign SABRE, which was simultaneously an information system (or a database, recording bookings in each fare class at the flight level) and a distribution infrastructure (a marketplace). They asked: how to expand it, and turn it into a pricing system (able to manage which fares were available for sale on each flight from a network flow management perspective)?

The articulation of that problem is historically significant. American Airlines’ operations researchers sought to solve a business problem, the implementation of a sophisticated new pricing strategy, which aimed at making pricing more dynamic, more market-responsive, more granular. But they did not look for the theoretically optimal solution. Instead, they sought to deploy a new technology. To do so, they started from an already existing technology, identifying the constrains and opportunities it offered. This already existing technology (SABRE) was a global electronic commerce infrastructure, i.e. the marketplace itself, coupled with a large database on bookings, i.e. customers’ purchasing behavior.

I spent most of the talk narrating how American Airlines’ operations researchers came to a solution. I tried to show how their thinking was shaped by the details of the distribution infrastructure: how airlines’ products were sold to customers through a computerized system, i.e. the features of the marketplace itself. I also tried to show how their thinking was shaped by the data (availability and size) and the computing power they had access to.

I argued that the crucial step to the solution was nothing spectacular, just a hack in SABRE called ‘virtual nesting’. This hack enabled the management at the flight level of the availability of the connecting fare classes, when working with two new components plugged into SABRE. First, an automated demand forecast, powered by statistical and probabilistic approaches, extracted the historical booking data in each fare class in each flight from SABRE, and then provided an expected revenue for each ‘virtual bucket’ on a flight. The expected revenue of a bucket meant the average price of the range of fare classes clustered in the bucket, weighted by the probability of having that many customers booking in that bucket. Second, an algorithm allocated a number of seats to each bucket of fare classes, given the average expected revenue for each bucket; this component was called the optimizer. The mathematics supporting the optimization were not trivial. American Airlines’ operations researchers used mathematical programming approaches which belonged to the standard toolbox of operations research at the time. However, these tools needed to be creatively applied to the specific problem at hand, accounting in particular for the limitations in computing power. This required the development of completely new heuristics. Overall, using mathematical programming to make pricing more dynamic, more market responsive, and much more fine-grained than it had ever been before in any industry, was an important innovation. And it all hinged on a hack in SABRE.

DINAMO opened decades of intense research and development to improve the ‘hack’, the forecasting, and the optimization. The underlying logic is still in use today, at least in the largest networked airlines. It directly inspired marketplace engineers in many industries, from Amazon to Uber, from hotels to concert tickets sellers. It features prominently in the training of the future generation of marketplace engineers. And if your local supermarket uses digital price tags on the shelves, it is likely that they are using a version of it too.

Sources

The knowledge produced by marketplace engineers is not widely shared beyond the community of specialists. Furthermore, it is very practical and operational, and for that reason not fully codified in the scientific literature. Therefore, the main sources for my research are interviews with the engineers and scientists who built these systems in airlines (50 people interviewed so far, and the list is still open!). I asked them how they proceeded, the resources they had, the environment they were working in, what their thought process was, their path to the solution. My interviewees also walked me through the technical literature they have produced, in particular technical presentations delivered at an industry forum called AGIFORS, the Airline Group of the International Federation of Operational Research Societies. This talk on DINAMO drew on my broader research project, in which I study the practices, forms of reasoning, and ways of thinking of engineers and scientists who built revenue management systems in the airline industry, from the origins in the 1980s to today. On DINAMO, the interested reader can start with this great paper that was published by its three main inventors: Smith, Leimkuhler and Darrow (1992) ‘Yield Management at American Airlines’ Interfaces 22 (1), pp. 8-31.

Proposed citation: Guillaume Yon. 2024. Marketplace Engineers at Work: How Dynamic Airline Ticket Pricing Came into Being. https://khk.rwth-aachen.de/2024/01/31/9192/marketplace-engineers-at-work-how-dynamic-airline-ticket-pricing-came-into-being/.